Gold Reevaluation

The U.S. could reevaluate the price of gold to help address its national debt by significantly increasing its official valuation. With over 260 million ounces in reserves, raising gold’s price—say, from $2,000 to $10,000 per ounce—could create trillions in new dollar liquidity to offset debt. However, this approach carries risks, including inflation and potential instability.

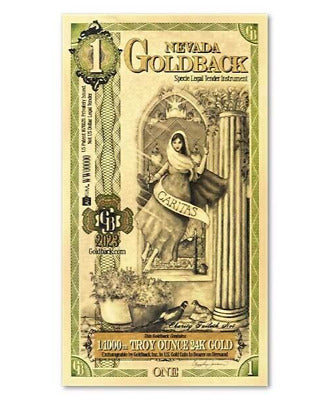

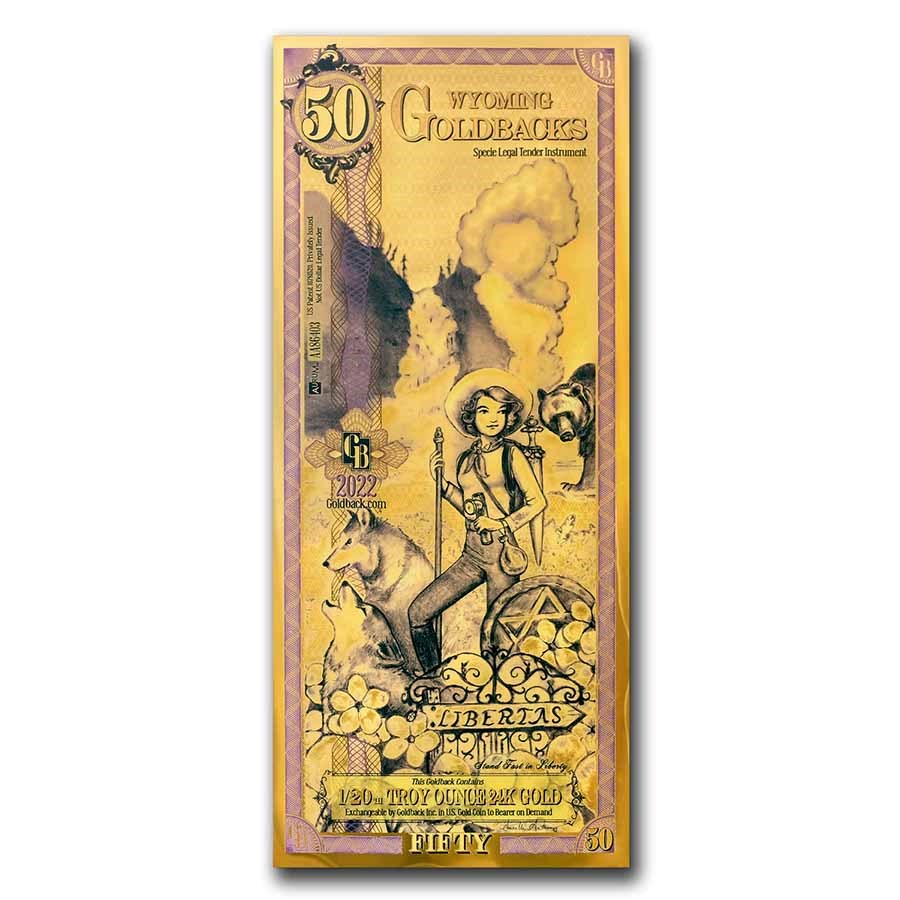

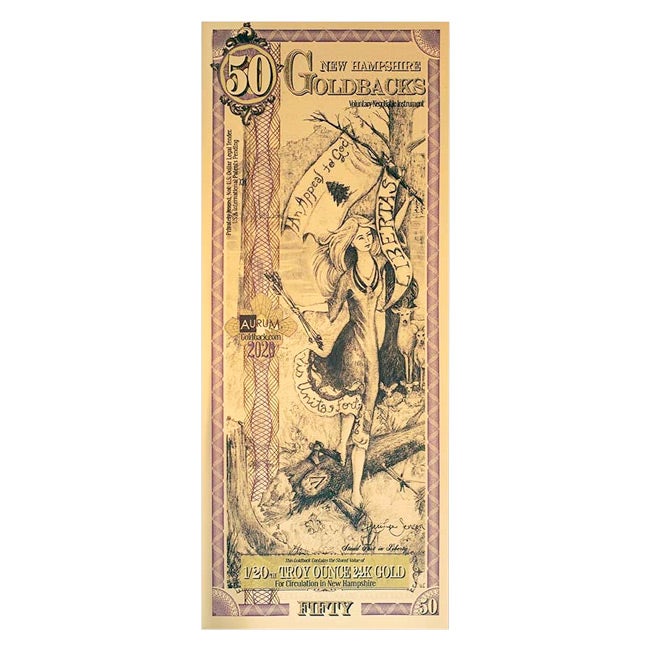

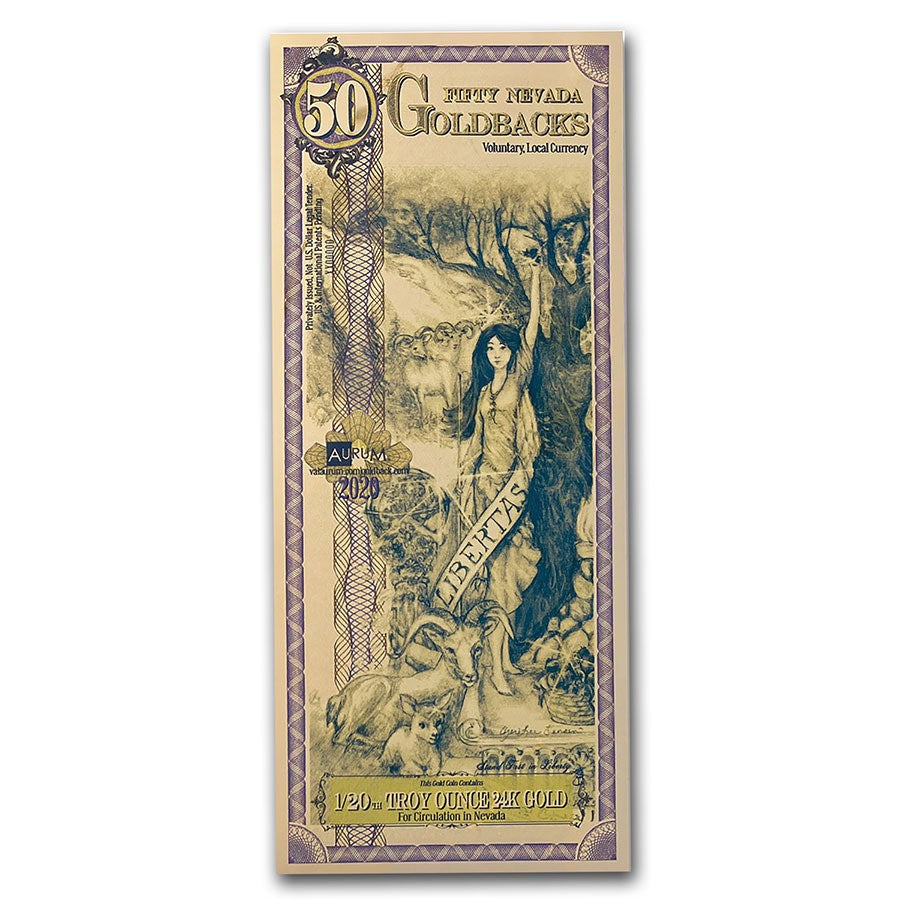

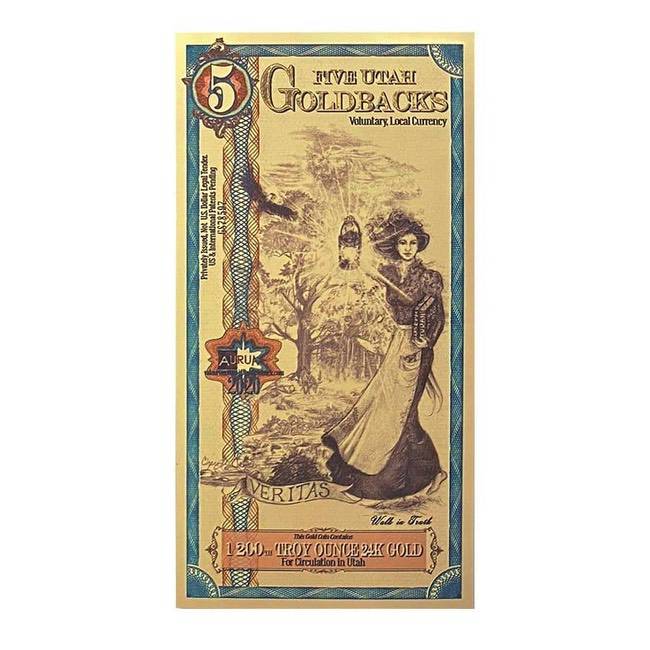

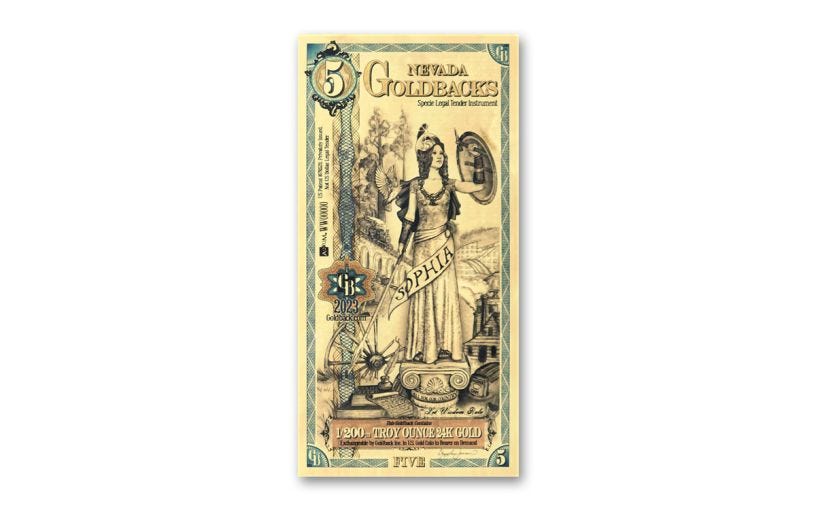

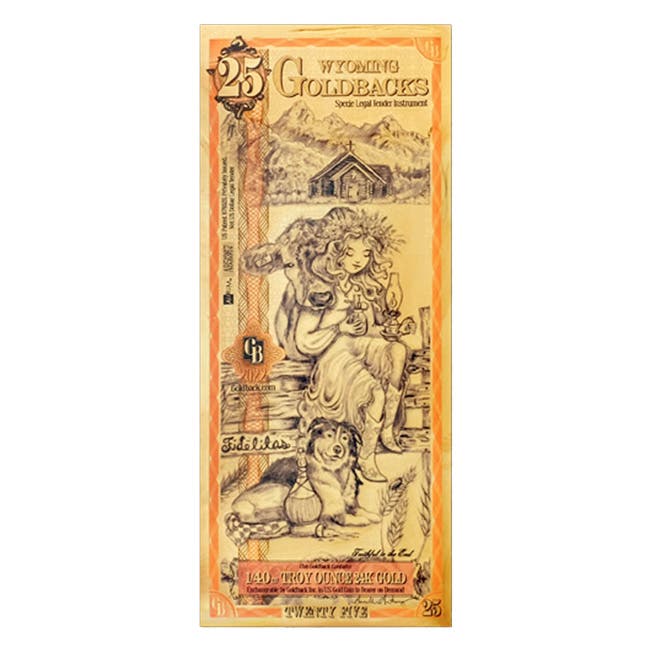

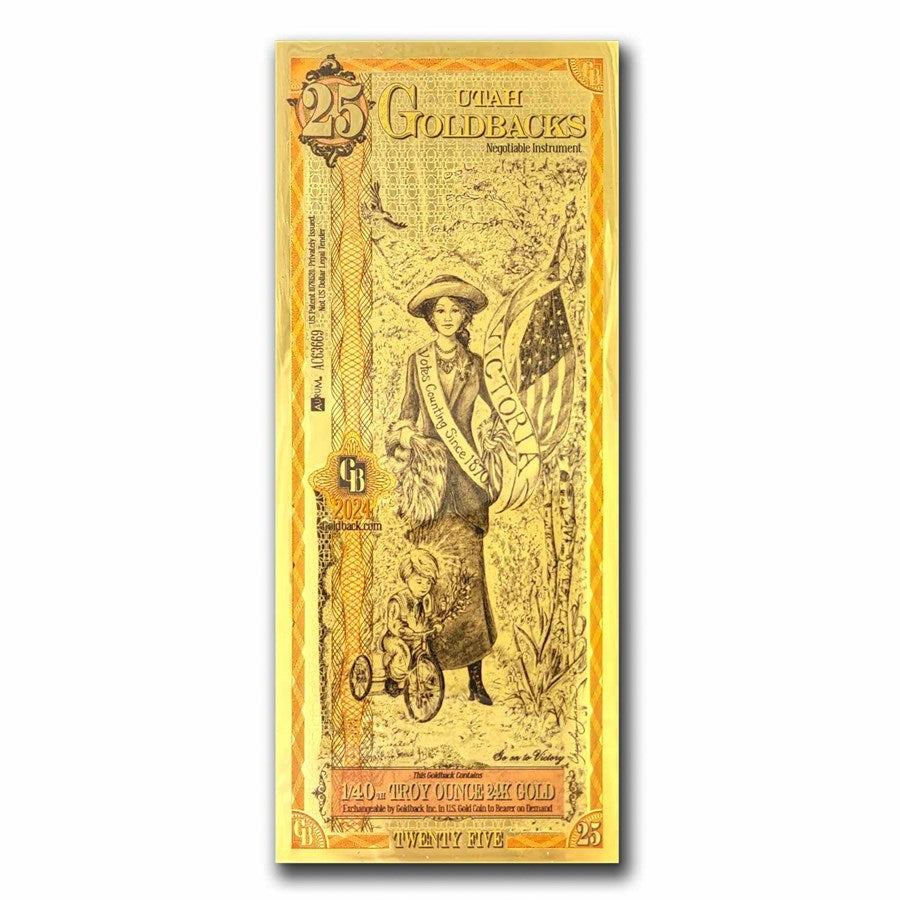

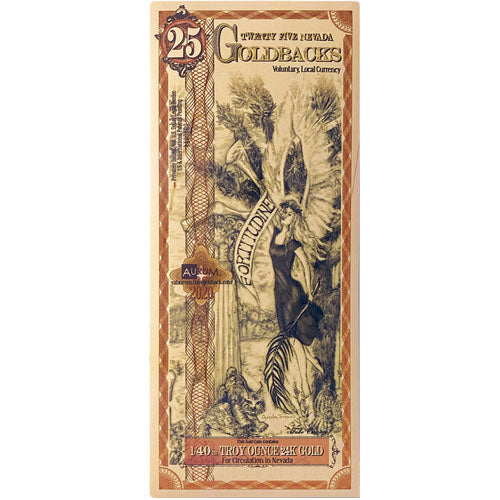

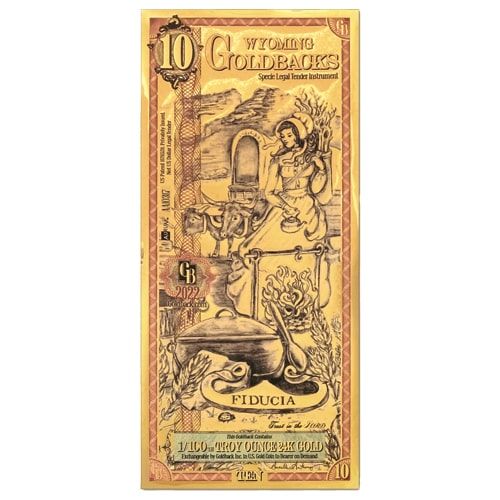

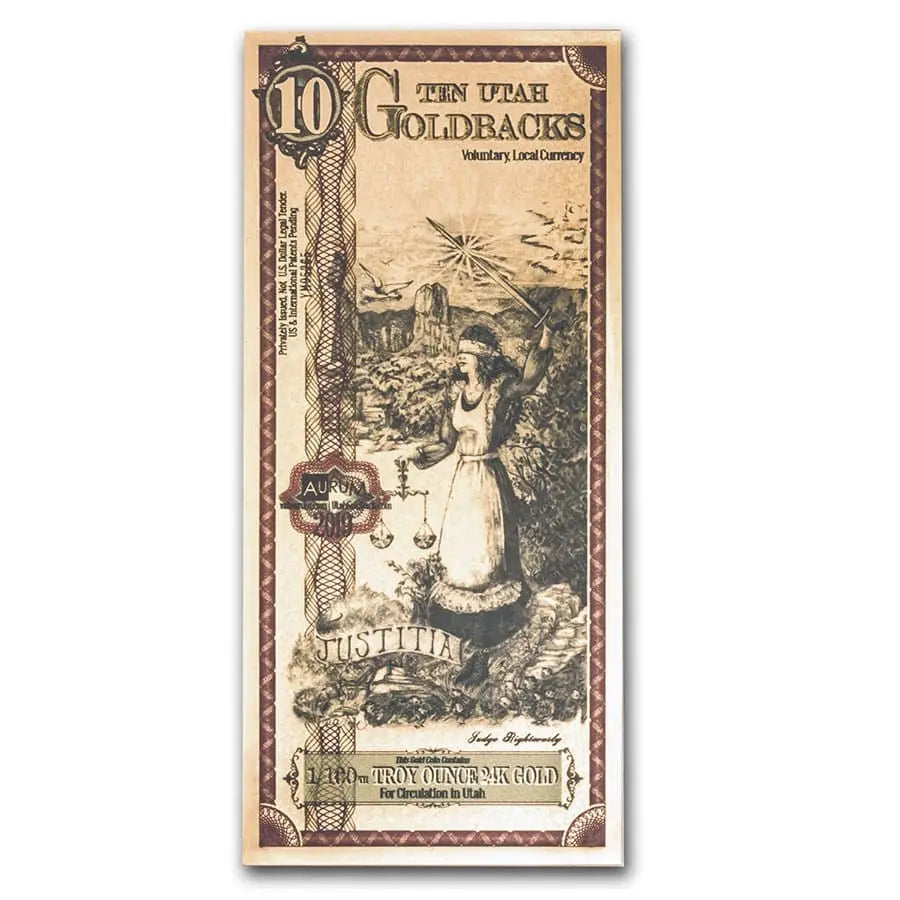

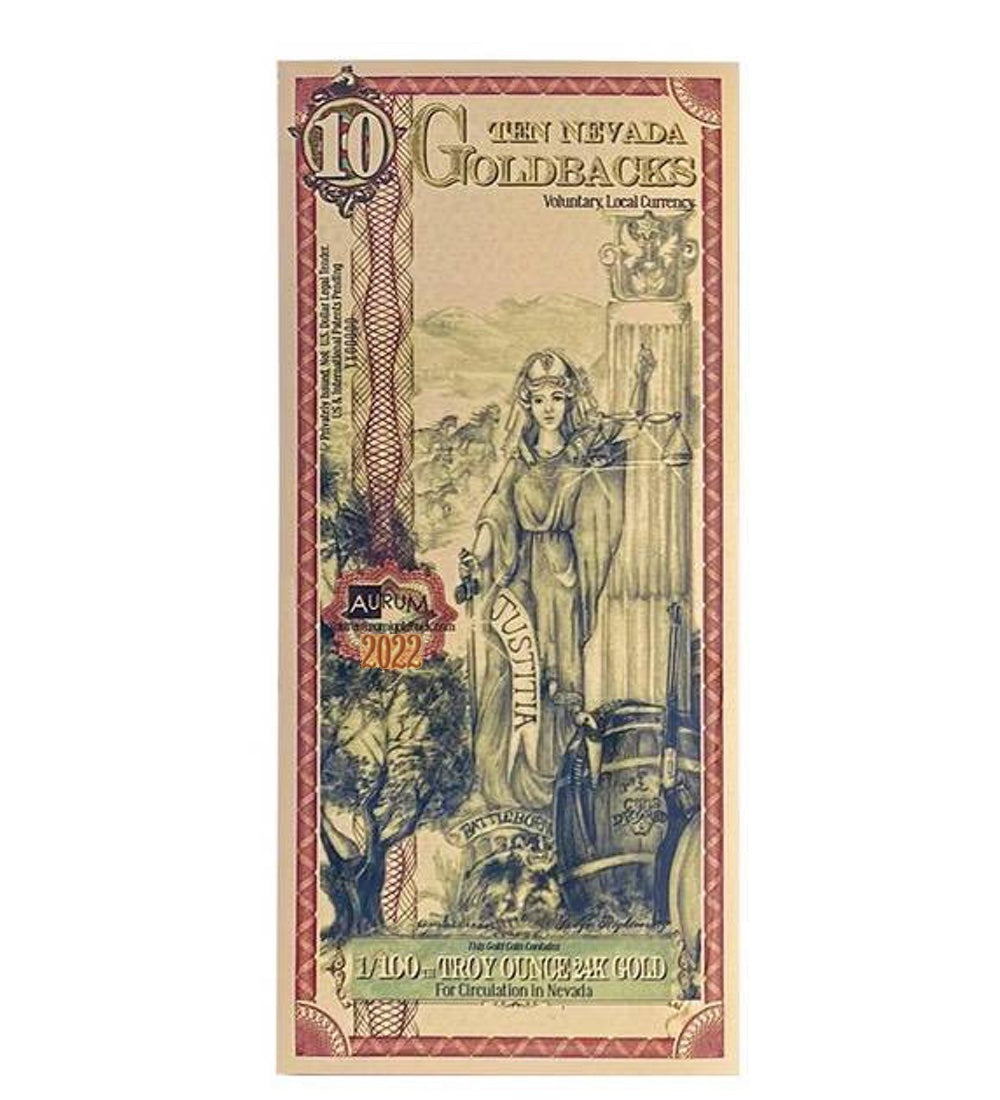

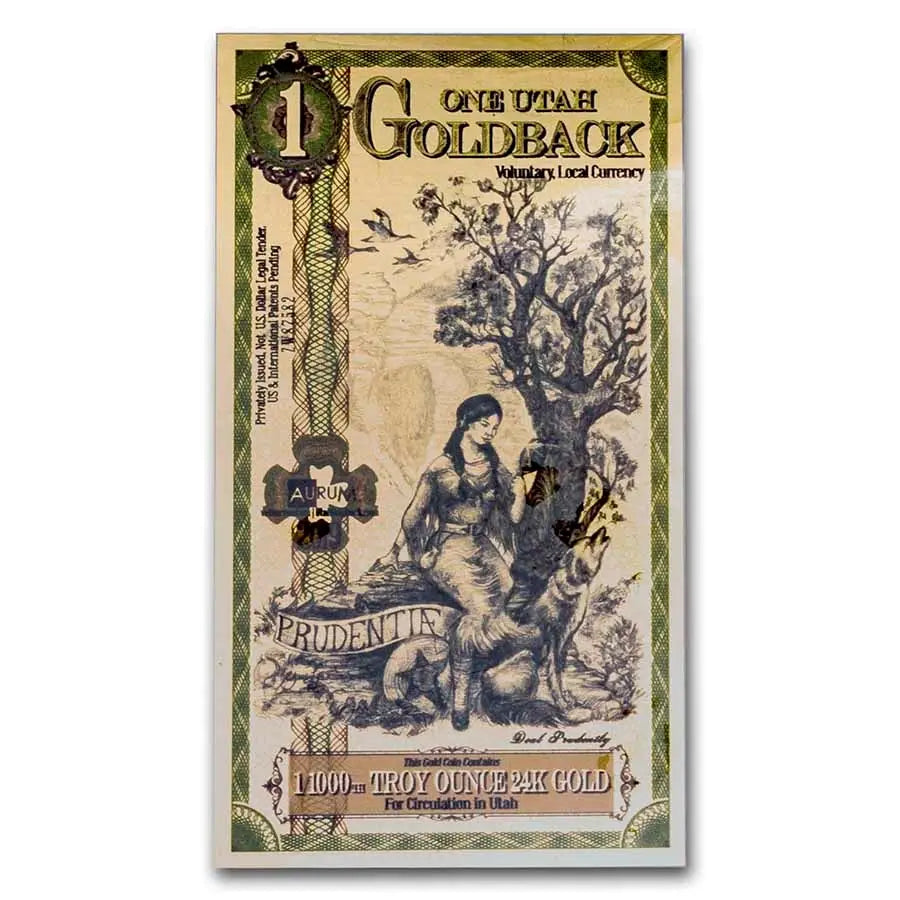

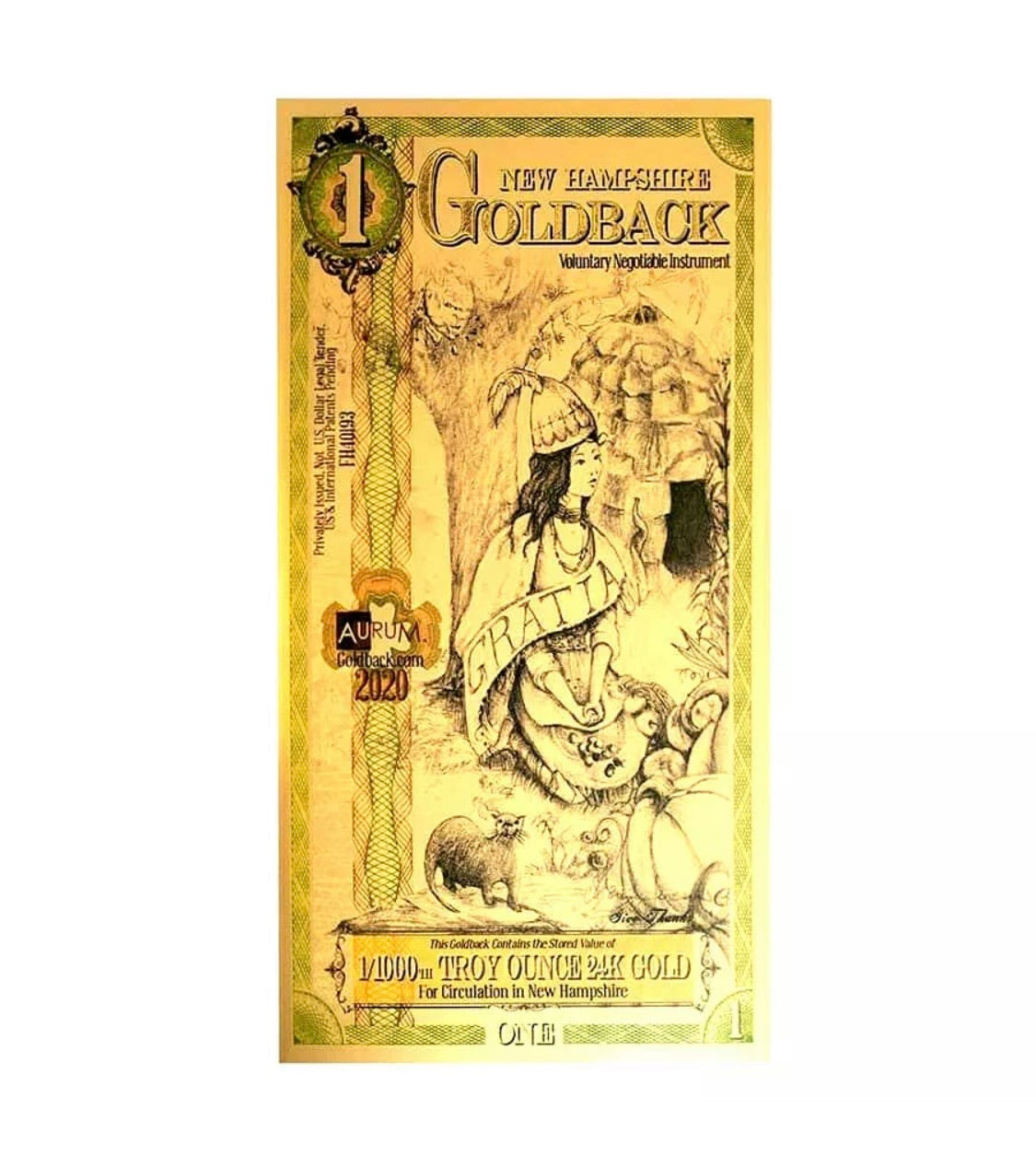

Goldback (cash made of gold) offer a way to use gold in daily transactions. These spendable, small-denomination gold notes hold intrinsic value and protect against inflation. Unlike digital or paper currency, Goldbacks provide a hedge against devaluation, allowing individuals to store and use real wealth in a tangible form. If gold is revalued, assets like Goldbacks could become even more valuable, helping people retain purchasing power in uncertain economic times.